The Riffle

The Virtual Assets Regulatory Authority (VARA) has issued formal guidance clarifying how Virtual Asset Service Providers (VASPs) must classify and onboard investors operating in Dubai, including Mainland and Free Zones.

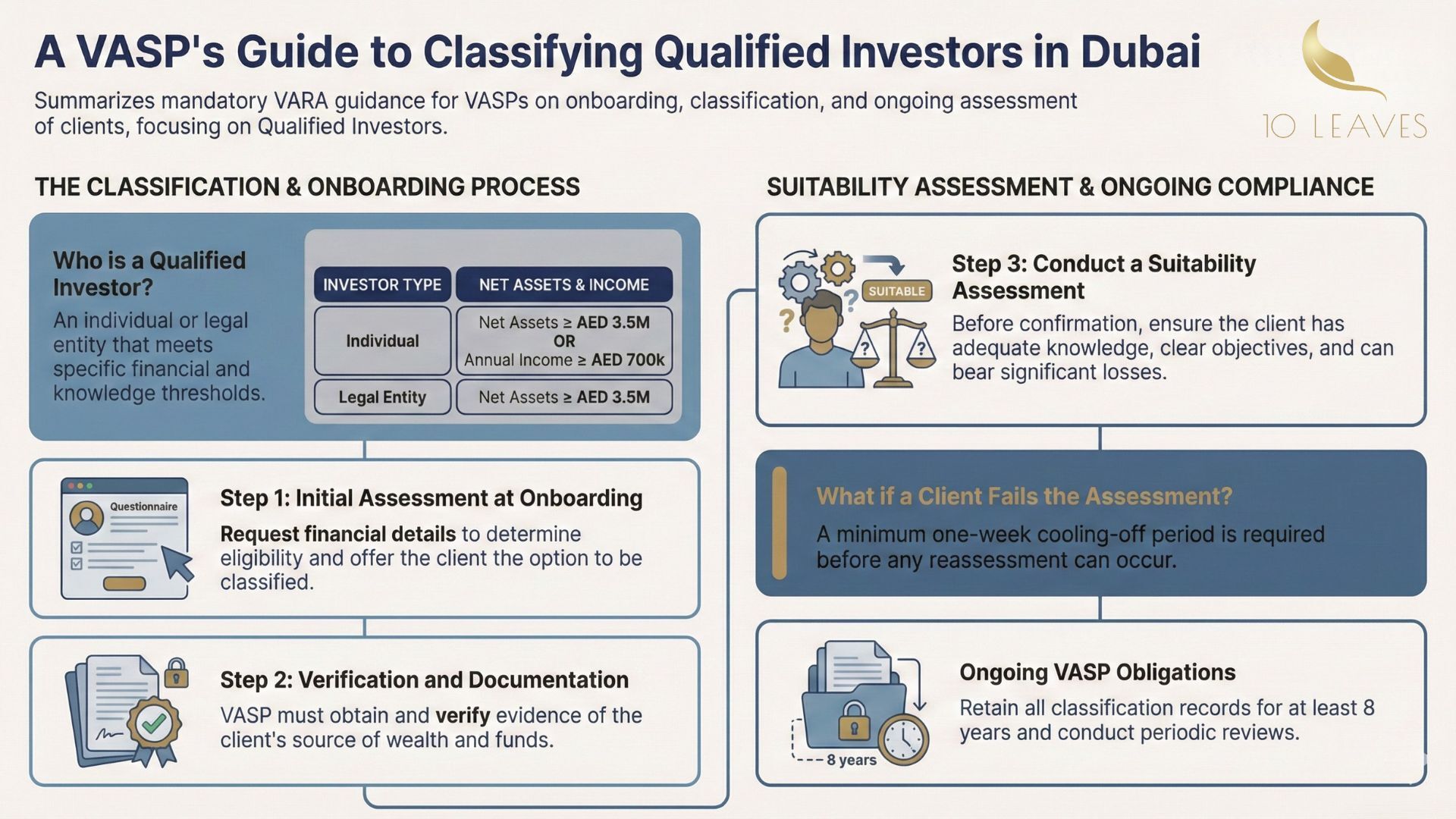

Effective 8 January 2026, the guidance standardises investor categorisation, strengthens financial eligibility thresholds, and reinforces suitability assessments before clients can access higher-risk virtual asset products. VASPs are required to immediately align their onboarding, documentation and internal control frameworks to avoid regulatory action.

Key Highlights

Mandatory classification of clients as Retail, Qualified Investor or Institutional Client

AED 3.5 million net asset threshold introduced for Qualified Investors

Explicit requirement for robust suitability assessments before access to high-risk products

Clients must be given a choice of classification if eligibility thresholds are met

Cooling-off period applies where suitability assessments are failed

Investor classification must be reviewed throughout the client lifecycle

Record-keeping requirements extended to eight years

Investor Classification Framework

Under the Market Conduct Rulebook (Part IV), VASPs may only conduct virtual asset activities with clients appropriately classified.

Qualified Investor eligibility includes:

Individuals

Demonstrated knowledge of virtual assets or complex financial products

Net assets of AED 3,500,000 (excluding primary residence)

And/or annual income of AED 700,000

Legal Entities

Net assets of at least AED 3,500,000

Directors with relevant virtual asset knowledge

Eligible clients must be allowed to elect whether they wish to remain Retail or be treated as Qualified Investors.

Onboarding & Verification Requirements

VASPs are required to adopt proactive financial screening during onboarding, including:

Collection of income and net asset data

Clear disclosure of the risks and privileges attached to Qualified Investor status

Explicit client consent prior to reclassification

Where Qualified Investor status is selected, VASPs must obtain and verify:

Source of Wealth (SoW) and, where applicable, Source of Funds (SoF)

Reliable documentation evidencing liquidity and financial thresholds

Suitability Assessments: The Final Gatekeeper

Before confirming classification, VASPs must conduct a “robust and sufficient” suitability assessment demonstrating that the client:

Possesses adequate knowledge and experience

Has clearly defined investment objectives

Can financially withstand sudden or significant losses

If suitability is not met:

A mandatory one-week cooling-off period applies

Clients may continue as Retail Investors during this period

Any reassessment must be substantively different from the original test

Lifecycle Management & Client Upgrades

Investor classification is not static. VASPs must reassess classification when:

Clients request access to Qualified-only or high-risk products

Updated financial data meets eligibility thresholds

Trading behaviour indicates a material change in financial profile

Upgrades require:

Prior disclosure of implications

Explicit client consent

Full satisfaction of both financial eligibility and suitability

Until completed, clients must remain classified as Retail.

Why This Matters

This guidance signals VARA’s continued focus on:

Investor protection in high-risk virtual asset markets

Consistent onboarding standards across the ecosystem

Preventing mis-selling and inappropriate product access

Strengthening governance, documentation and supervisory readiness among VASPs

For firms, investor onboarding is no longer a front-end formality—it is a continuing compliance obligation.

Next Steps for VASPs

VASPs should:

Review and update investor classification policies

Re-engineer onboarding and suitability assessment workflows

Train front-office and compliance teams

Conduct internal gap assessments against VARA expectations

Prepare for supervisory reviews and evidence requests

Conclusion

With immediate effect, VARA expects full alignment with its investor classification and onboarding framework. Firms failing to comply risk regulatory action under the Virtual Assets and Related Activities Regulations and applicable Rulebooks.

This guidance reinforces a clear regulatory message: access to virtual asset markets must be matched with financial capacity, knowledge and accountability.

Read the full briefing document presented by 10 Leaves here -