The Riffle

The Abu Dhabi Global Market (ADGM) continues to strengthen its regulatory landscape with the Code of Market Conduct (CMC) — a key framework issued by the Financial Services Regulatory Authority (FSRA). The Code supplements the Market Abuse provisions in the Financial Services and Markets Regulations 2015 (FSMR) and provides practical guidance on identifying, preventing, and reporting market misconduct.

The CMC ensures that everyone — whether regulated or not — who participates in ADGM’s markets upholds fairness, transparency, and integrity. It applies not only to conduct within the ADGM, but also to any actions outside the jurisdiction that may impact its markets.

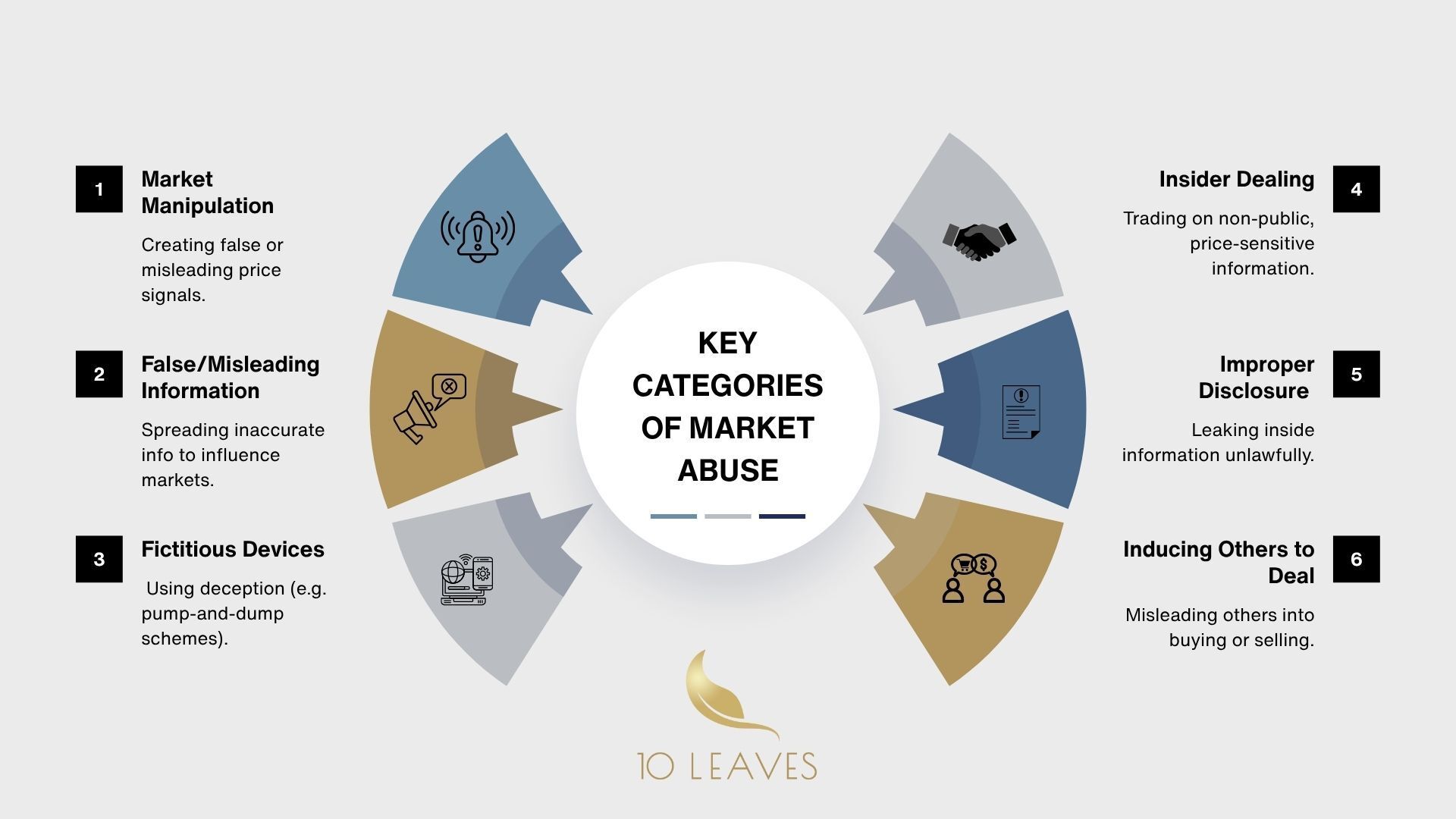

Key Categories of Market Abuse

The Code defines six principal forms of market misconduct, each supported by real-world examples and defenses:

1. Market Manipulation

Creating a false or misleading impression of supply, demand, or price, or securing prices at artificial levels.

Common forms include:

Wash Trades – transactions with no real change in ownership.

Layering – placing and cancelling multiple orders to distort the market.

Abusive Squeeze – exploiting control over supply or demand to influence prices.

Legitimate defenses include accepted market practices, price stabilisation, and buy-back programmes.

2. Dissemination of False or Misleading Information

When false information is spread knowingly or recklessly — via media, social channels, or public statements — to mislead investors or manipulate prices.

3. Use of Fictitious Devices and Deception

Using deceptive tactics such as pump-and-dump or trash-and-cash schemes to profit from artificial price movements.

4. Insider Dealing

Trading based on inside information — non-public, precise, and price-sensitive data — remains one of the most serious forms of abuse.

Examples include:

Front-running client orders.

Trading before takeover announcements.

Tipping friends or family before key disclosures.

5. Improper Disclosure of Inside Information

Revealing confidential or price-sensitive information outside the proper course of one’s employment or duties — even without any trading — constitutes a breach.

6. Inducing Another Person to Deal

Making false or exaggerated claims to persuade others to buy or sell financial instruments — as seen in “boiler room” scams or misleading marketing communications.

Defenses and Legitimate Market Practices

The Code acknowledges legitimate activities that may appear similar to market abuse but serve valid purposes:

Market making and underwriting within professional obligations.

Executing unsolicited client orders without influencing client decisions.

Maintaining Chinese Walls to prevent the misuse of inside information.

Short selling and stock lending — legitimate when free from manipulative intent.

Enforcement and Sanctions

Under Part 19 of the FSMR, the FSRA holds strong enforcement powers, including:

Public censures or private warnings.

Financial penalties.

Suspension or restriction of permissions.

Prohibition orders for individuals or firms.

The severity of sanctions depends on the gravity and duration of the breach, financial gains, level of cooperation, and preventive measures taken.

Why This Matters

ADGM’s Code of Market Conduct reaffirms the jurisdiction’s commitment to maintaining a fair, transparent, and well-functioning market ecosystem — one where investor confidence is protected, and misconduct has no place.

As ADGM continues to attract global participants, the CMC serves as a critical compass for firms, issuers, and professionals — helping them navigate the fine line between legitimate trading strategies and manipulative conduct.

Summary

Applies to both regulated and unregulated persons.

Covers market manipulation, insider dealing, and improper disclosures.

Establishes legitimate defenses and market practices.

Empowers FSRA with robust enforcement measures.