The Riffle

The Abu Dhabi Global Market (ADGM) Registration Authority (RA) has released its DNFBPs Common Findings Report 2024, following 32 onsite AML/TFS assessments - a 28% increase from 2023.

The review covered Company Service Providers, Legal Consultancies, Real Estate Agents, Auditors, Accountants, and Dealers of high-value goods. The findings reveal recurring compliance gaps that DNFBPs must address to meet Anti-Money Laundering (AML) and Targeted Financial Sanctions (TFS) obligations.

What are DNFBPs?

DNFBPs as defined by FATF and supervised in ADGM include:

Real estate agents

Dealers in precious metals/stones or high-value goods

Lawyers, notaries, accountants, and other independent legal professionals

Trust and company service providers

These sectors are considered vulnerable to money laundering (ML) and terrorist financing (TF) risks and must meet strict AML/TFS compliance standards.

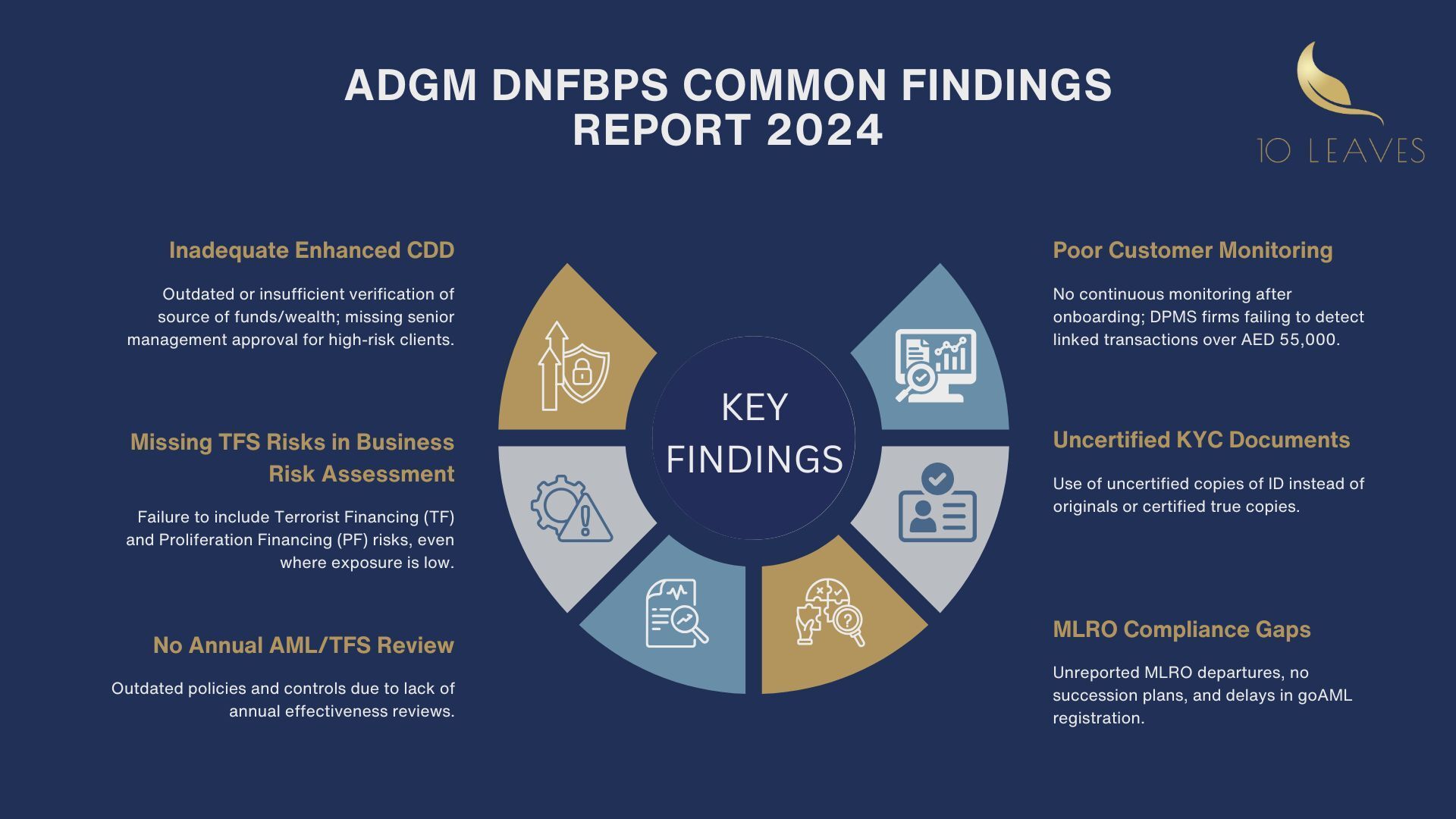

Six Key Findings from the 2024 Assessments

1. Inadequate Enhanced Customer Due Diligence (CDD)

Issue: Outdated bank statements used to verify source of funds/wealth; missing senior management approvals for high-risk clients.

Expectation: Gather sufficient, recent evidence of source of funds and wealth, and get prior approval before onboarding high-risk customers.

2. Missing TFS Risks in Business Risk Assessments (BRA)

Issue: Some firms skipped Terrorist Financing and Proliferation Financing risks in their BRA.

Expectation: Explicitly include TFS risks, even if perceived exposure is low.

3. No Annual Review of AML/TFS Framework

Issue: Firms failed to review AML/TFS policies, procedures, systems, and controls annually.

Expectation: Conduct yearly reviews, present findings to senior management, and create a remediation plan for gaps.

4. Weak Ongoing Customer Screening

Issue: No continuous monitoring after onboarding; DPMS firms missed linked transactions over AED 55,000.

Expectation: Implement systems for ongoing screening, including adverse media checks and transaction tracking.

5. Uncertified KYC Documents

Issue: Uncertified ID copies used instead of original or certified documents.

Expectation: Use certified true copies if originals can’t be reviewed in person — certified by an authorised professional.

6. MLRO Arrangement Failures

Issue: MLRO departures not reported; no transition or succession plans; delays in goAML registration.

Expectation: Appoint a qualified, independent MLRO, notify the RA of changes immediately, and ensure smooth transitions.

The RA’s message is clear: compliance is non-negotiable. DNFBPs must take immediate, proactive steps to align with AML/TFS requirements or risk enforcement action.

In summary:

Treat the report as a compliance health check.

Prioritise remediation within three months of identifying gaps.

Keep policies updated in line with regulatory changes.

Ensure senior management is informed and accountable.

By acting now, DNFBPs can strengthen their governance, reduce regulatory risk, and demonstrate a strong commitment to compliance.

Read the briefing document presented by 10 Leaves here -