The Riffle

The Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM) has released Discussion Paper No. 1 of 2025, proposing a significant update to its insurance regulatory framework, with a particular focus on reinsurance.

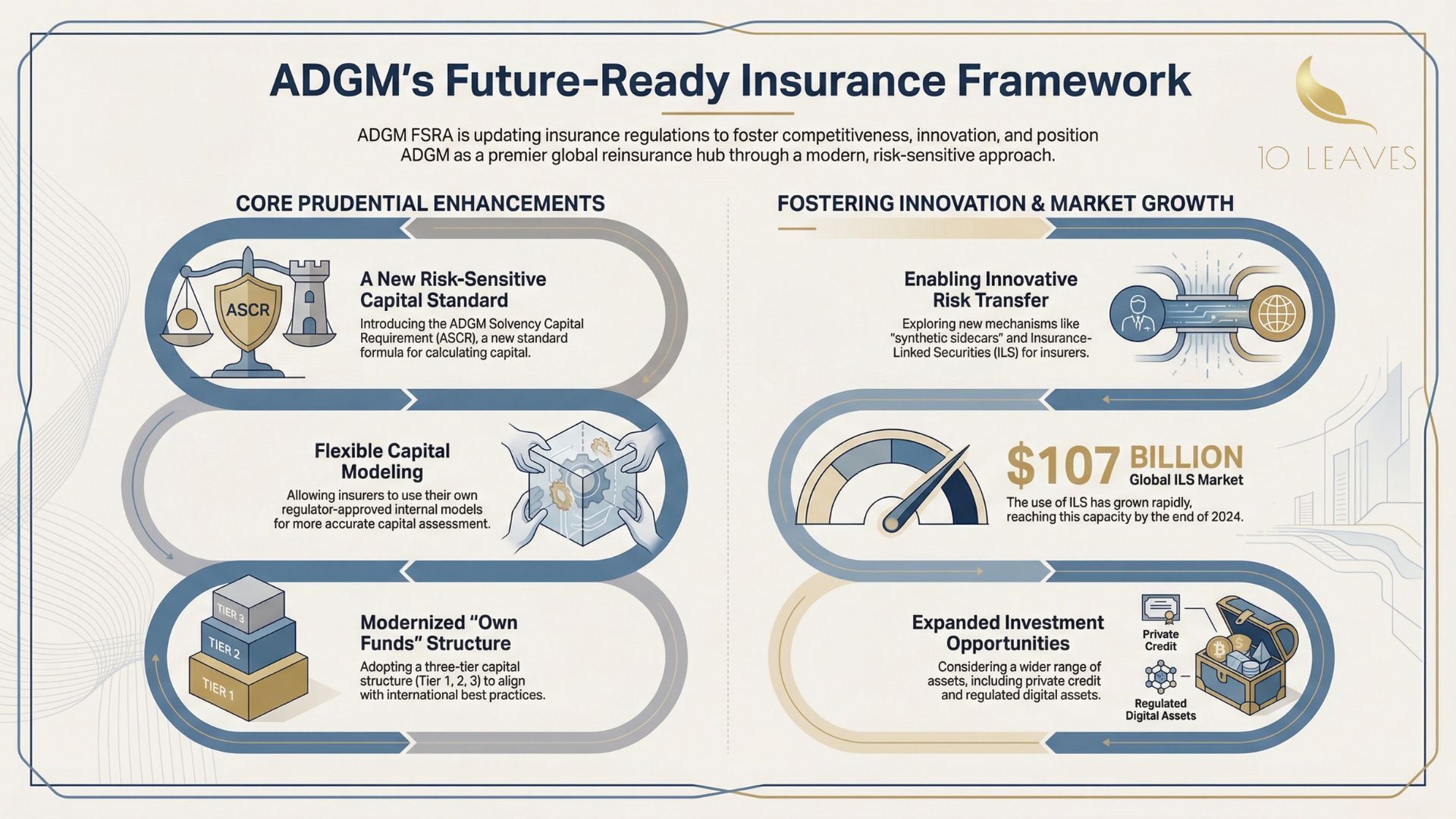

The proposals aim to transition ADGM towards a more risk-sensitive, economic capital-based regime, aligning the jurisdiction with leading international standards such as Solvency II, Bermuda’s BSCR, and the IAIS Insurance Core Principles. The overarching objective is to enhance competitiveness, support innovation, and position ADGM as a globally attractive hub for insurance and reinsurance activity.

Key Highlights

Core Prudential Reforms

Introduction of the ADGM Solvency Capital Requirement (ASCR) as the primary capital metric, calculated using a Value-at-Risk methodology over a one-year horizon

Explicit recognition of diversification benefits across geographic, sectoral, and product exposures

Adoption of a look-through approach for indirect asset exposures

Establishment of target capital ratios, with a baseline expectation of 120% of ASCR and higher thresholds (e.g. 150%) for higher-risk insurers

Development of a graduated supervisory intervention framework linked to breaches of ASCR and Minimum Capital Requirements

Introduction of a three-tier own funds structure, defining capital quality and eligibility limits across Tier 1, Tier 2, and Tier 3 instruments

Permission for insurers to use FSRA-approved internal models, including full, partial, or off-the-shelf models, subject to robust governance and validation

Innovation and Market Development

Exploration of synthetic sidecars as fully funded, on-balance-sheet risk transfer mechanisms

Consideration of a regulated framework for Insurance-Linked Securities (ILS) in ADGM to facilitate risk transfer to capital markets

Investment and Risk Management Enhancements

Shift towards a Prudent Person Principle for investment decision-making

Expanded eligibility of alternative and specialist assets, including private credit and structured products

Conditional use of digital assets, including fiat-referenced tokens, where appropriately matched to liabilities

Enhanced focus on liquidity, counterparty, and margin risks arising from derivatives usage

Governance and Supervision

Principles-based approach to group supervision

Strengthened qualitative risk management and governance expectations

Introduction of structured recovery and resolution planning for insurers in financial distress

Why This Matters

These proposals signal a strategic recalibration of ADGM’s insurance regime, moving away from rigid, rules-based capital requirements towards a framework that better reflects underlying risk.

For insurers and reinsurers, the changes may:

Reduce unnecessary capital friction

Enable more sophisticated capital and risk management strategies

Improve access to alternative capital and investment opportunities

At a market level, the framework supports ADGM’s ambition to compete with established global reinsurance centres, while maintaining strong prudential oversight and policyholder protection.

Important Next Steps

FSRA is seeking written feedback from insurers, reinsurers, intermediaries, investment managers, and other stakeholders

Consultation deadline: 16 February 2026

Responses should be submitted to [email protected]

FSRA expects to release further detailed consultation papers throughout 2026, translating these high-level proposals into specific regulatory rules

Conclusion

The proposed update represents one of the most comprehensive evolutions of ADGM’s insurance regulatory framework to date. By combining global best practices with a forward-looking, innovation-friendly approach, the FSRA is laying the groundwork for a more competitive, resilient, and internationally aligned insurance and reinsurance ecosystem in ADGM.

Stakeholder engagement at this stage will be critical in shaping a framework that supports sustainable growth while safeguarding market stability.